Autora:

Miriam Sánchez González

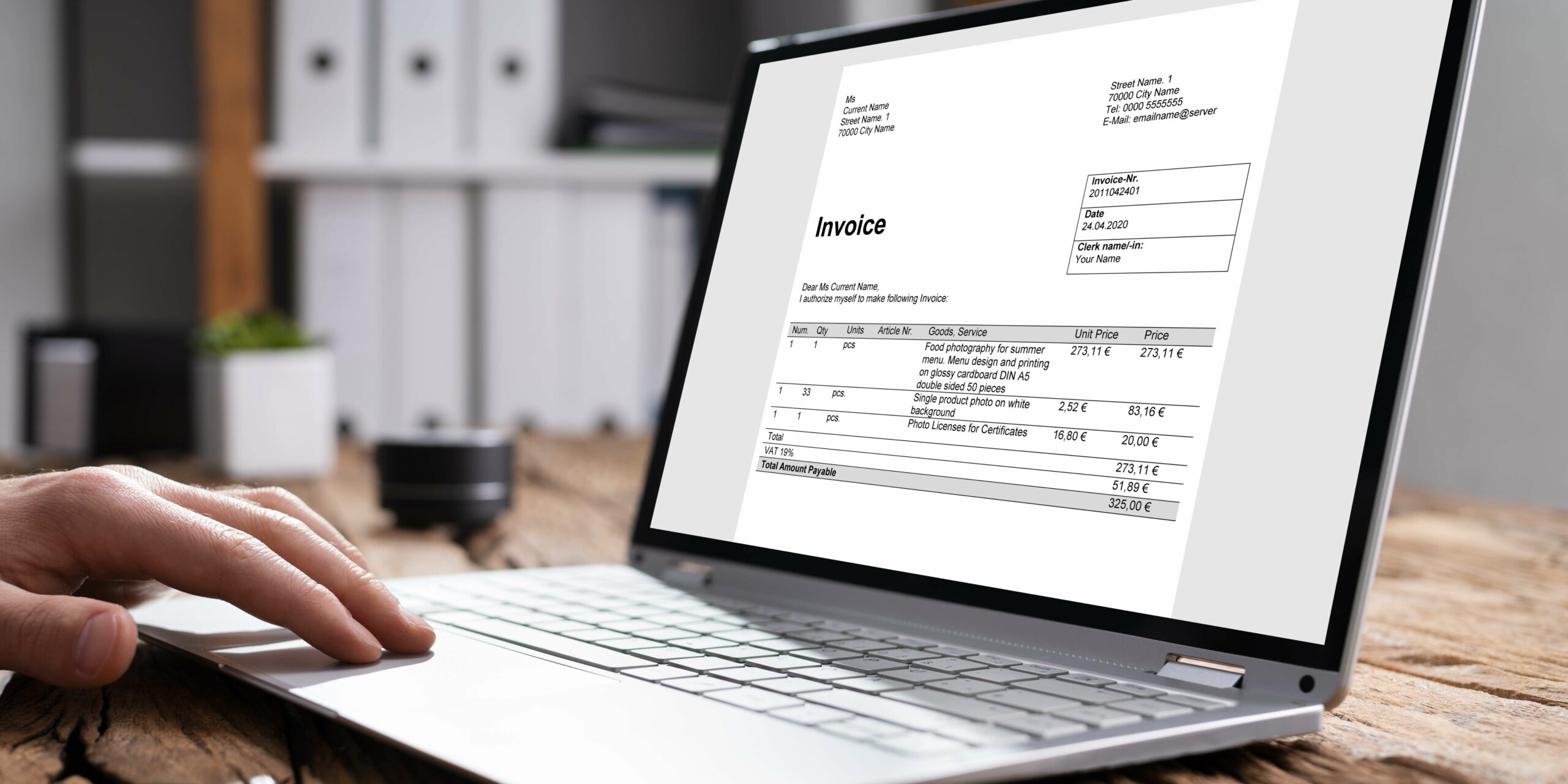

Electronic invoicing and the Verifactu

The deadline for the entry into force of the electronic invoice is approaching and, as of today, the two projects, promoted by the Ministry of Economy, Trade and Enterprise and the Ministry of Finance, regarding invoice digitalization are in the making.

Nos referimos a:

- The mandatory electronic invoicing that will be imposed for transactions between business people and professionals (“B2B transactions”), and which was approved by the Law 18/2022, of September 28, for the creation and growth of companies (known as the “Crea y Crece Law”).

- The requirements to be met by computer or electronic invoicing systems and programs, and which impose obligations on both the programmers and marketers of the aforementioned software and its users; all this in development of the amendment made to the General Tax Law 58/2003, through Law 11/2021, of July 9, on measures to prevent and combat tax fraud, to put an end to the production and use of programs that allow accounting manipulation, the so-called “dual-use software”.

In addition, users of these programs may voluntarily send all their invoicing records generated to the Tax Agency’s electronic headquarters, being understood that they opt for the “Verifiable Invoice Issuing System” or “Veri*factu System”.

The truth is that little progress has been made in the development of these two projects in recent months, which means that a delay in the initially planned entry into force cannot be ruled out.

Mandatory electronic invoicing for B2B transactions

In Spain, this project is part of the Crea y Crece Law, which was approved in 2022. This regulation establishes that all companies and freelancers must issue and receive electronic invoices in their B2B commercial transactions. The use of electronic invoicing was already mandatory in transactions with the Public Administration, but with this project, its mandatory nature is extended to transactions between private companies.

Since the publication in the Official State Gazette (BOE) of the aforementioned Law 18/2022, the regulatory development, by means of Royal Decree, of this new obligation that will affect companies and individuals, businessmen and professionals, (regardless of their volume of operations and, therefore, whether or not they are affected by the Immediate Supply of Information on Value Added Tax, known as “SII-VAT”), is still pending approval.

The entry into force of the electronic invoicing obligation is subject to the approval and publication of its regulatory development, as follows:

- For entrepreneurs and professionals whose annual turnover exceeds eight million euros, in the year of publication of the Regulation.

- For the rest of the entrepreneurs and professionals, two years after the publication of the Regulation.

The Ministerial Order with the development of the technical specifications is also pending approval, and a draft text has not yet been made public.

Furthermore, the new obligation to issue/receive electronic invoices in B2B transactions is subject to the European Commission obtaining a Community exception. For the time being, there is no evidence that the European Commission has authorized such a derogation.

As mentioned above, the date of approval of the Regulation is key to determine the exact date of entry into force of this new obligation. As long as it is delayed, its entry into force will also be delayed. On the other hand, it cannot be ruled out that the Regulation and the Ministerial Order will be approved almost simultaneously, in order to avoid the scenario in which we find ourselves in the project discussed below.

Verifactu system and billing software and systems requirements

This new obligation will not affect businessmen and professionals who keep their VAT record books through the electronic headquarters of the AEAT (SII-IVA), thus excluding, among others, those with a turnover of more than 6,010,121 euros.

In this case, the Regulation on the requirements to be met by invoicing systems and computer programs has been approved by Royal Decree 1007/2023, of December 5.

However, the Ministerial Order with the technical specifications is still pending approval.

The entry into force, established in the regulation, of this new obligation is different depending on the subjects to which it imposes obligations:

- for software producers and marketers 9 months after the entry into force of the ministerial order

- and for users of the software as of July 1, 2025.

If the delay in the approval of the ministerial order persists, it is not feasible that the entry into force for users will be on July 1, 2025, since the 9 months from the approval of the order available to software producers and marketers to adapt their programs will end after that date. Consequently, everything seems to indicate that the entry into force for users of computer systems and programs will have to be postponed.

In conclusion, in the face of uncertainty, adaptability, strategic planning and flexibility are essential tools for navigating a changing environment and taking advantage of the opportunities that emerge in the midst of adversity.

¿Necesita ayuda? En Cigarrán Abogados podemos ayudarte (+34) 91.355.85.15