Author:

Miriam Sánchez González

VAT yes VAT no.

It is well known, by all of us who are dedicated to the world of consulting, the difficulty involved in the rules of VAT localization in the provision of services. Specifically, we refer to the wording of Articles 69 and 70 of the VAT Law where the wording is complex and unclear, which is confusing when determining whether or not a certain provision of services is subject to Spanish VAT.

With this article we will try to bring clarity to these rules, determining the applicability of Spanish VAT depending on the type of service in question, the condition of our client and the place of use of the service. Also, we will determine if in the supposition that the operation by application of the rules that later we will determine would not take Spanish VAT we would be speaking of an operation of those qualified as not subject or exempt.

When is a service rendered subject to Spanish VAT?

First of all, we must delimit the type of service within the consulting sector to which we are going to limit our study. In this case, we would be talking about consulting, legal, accounting and tax services.

Secondly, with regard to VAT, we must determine whether our client is a private individual or a businessman or professional acting as such, since the general rule is that if the recipient of a service is a businessman or professional, the operation is taxed at destination. At this point, we must emphasize that if our customer is located in a country of the European Union, the requirement to consider him as a businessman or professional for VAT purposes is that he is registered in the Register of Intra-Community Operators (ROI), in case he is not, we must consider that he is acting as a private individual.

In accordance with the above, the invoices that we issue to businessmen or professional clients located outside the territory of application of the tax, that is to say, outside the peninsular and Balearic Islands territory, we must issue our invoice without Spanish VAT as the operation is taxed at destination, that is to say, at our client’s place of business. On the other hand, if our client is acting as a private individual, either a private individual with residence in the Canary Islands, Ceuta and Melilla, in a territory outside the European Union or within the European Union but without ROI, we should include VAT in the invoice we issue to these clients.

Notwithstanding the above, the VAT regulations contain a closing clause for the services we are referring to (consultancy, law, accounting, tax, etc.). This closing clause, which has been subject to successive regulatory modifications, affects when our client is a private individual from outside the European Union, since if the service we are invoicing has utility in peninsular or Balearic territory we will have to include VAT in our invoice, while if the service does not have utility in peninsular or Balearic territory it will not include VAT. Due to the type of service we are dealing with, the most common is that we invoice a private individual from outside the EU because we are doing a job with utility in Spain, for example, the filing of a lawsuit, the fulfillment of their tax obligations in Spain, etc.

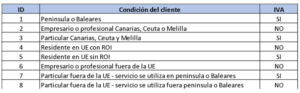

The following table summarizes the different cases depending on the condition of our client and the type of service we are dealing with:

Is the transaction non-subject or exempt, and is there a difference?

This is one of the big doubts when it comes to determine the correct declaration of a supply of services. Should I declare the operation as not subject or, on the contrary, would it be an exempt operation? Well, we would be talking about a non-subject operation, an operation that according to the VAT localization rules would not be subject to Spanish VAT but could be subject to VAT in the destination country.

On the other hand, we must say that an exempt operation, apart from exports and intra-community deliveries, are operations that for social, cultural reasons, etc. do not carry VAT, for example, health, education, etc. and whose realization entails tax consequences, which is the application of the pro-rata rule. In other words, exempt operations imply that you will not be able to deduct all the input VAT from your invoices received.

¿Necesita ayuda? En Cigarrán Abogados podemos ayudarte (+34) 91.355.85.15